va home equity loan texas

The lender also offers VA energy efficient mortgages allowing veterans to borrow additional money to pay for qualified improvements like solar. Purchase Loans and Cash-Out Refinance.

Va Eligible Properties Using A Va Loan For A Second Home

Thats because youll have to leave at.

. Most mortgage programs such as FHA and conventional loans require at least 35 percent to five percent downThats up to 12500 on a 250000 home purchase. With a VA loan you can buy immediately rather than years of saving for a down payment. The amount you save is based on your loan amount so.

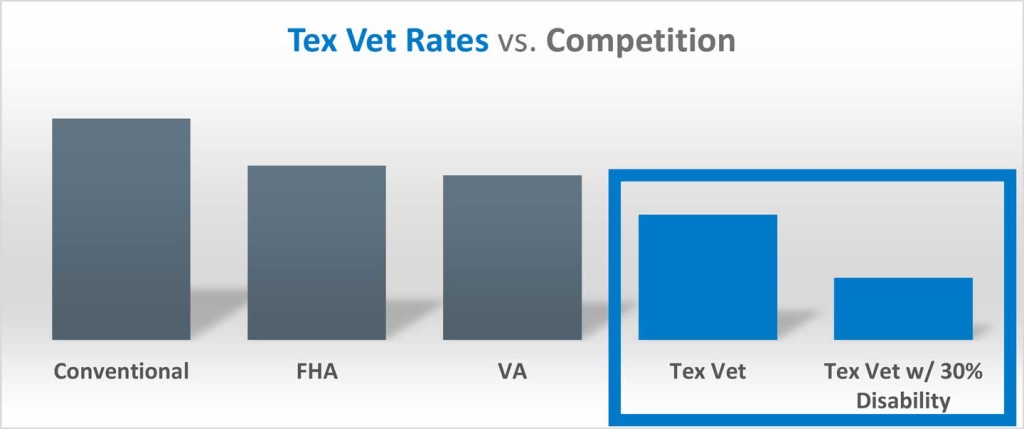

This program was introduced in 1986 to provide below-market interest rate loans to qualified Texas Veterans and Military Members for home repairs and. The loan increases the lien on the borrowers house and reduces the amount of equity they have in their home. The average 30-year VA refinance APR is 5180 according to Bankrates latest survey of the nations largest mortgage lenders.

Veterans United offers every mortgage loan product available under the VA loan program fixed and adjustable loans IRRRL loans cash-out refinance loans and jumbo loans except home equity loans and HELOCs. This loan allows you to take out a new VA mortgage for a larger amount than you currently owe providing the difference in cash. Some major expenses are paid for using Home Equity Loans such as paying off medical bills paying off some credit card debts home repairs or even to fund a college education.

No the VA does not offer a VA home equity loan. On a no-down-payment loan you can borrow up to the Fannie MaeFreddie Mac conforming loan limit in most areasand more. The interest paid on a home equity line of credit may be tax deductible if the money is used for certain expenses.

Texas home equity loan has. For today Monday May 02 2022 the national average 30-year VA. Many lenders will allow a home equity loan to be refinanced with a home equity line of credit if the borrower has had the loan for 12 months or longer and has not refinanced it within the past year.

To be eligible you must have satisfactory credit sufficient income to meet the expected monthly obligations and a valid Certificate of Eligibility COE. Payments do not include amounts for taxes and insurance premiums. Depending on the lender.

VA-guaranteed loans are available for homes for your occupancy or a spouse andor dependent for active duty service members. Since 1944 VA and private industry partners have helped deliver the dream of homeownership to generations of Veterans and Servicemembers. The VA backs only first-lien mortgages to help military families become homebuyers.

It is possible to take out home equity financing if you have an existing VA mortgage though the VA doesnt directly endorse or guarantee secondary financing like home equity loans or lines of credit so dont bother looking for VA-backed home equity loans. To get started with your VA Loan refinance today call us or fill out the short form on this page and a specialist on our team will contact and assist you. VA loans require a maximum 41 percent debt-to-income ratio.

Youll need more than 20 percent equity in your home to benefit from a cash-out refinance loan in Texas. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line amounts. Here Veterans describe how the VA Home Loan benefit has changed their lives and what home means.

Additionally theres no barrier to taking out a VA mortgage and seeking out a home equity loan when desired. In Texas it is commonly referred to as a Texas Cash Out. While there is no official VA home equity loan there is a VA-backed program that can help you access cash through the equity in your property.

A home equity loan helps people who already own homes so its not in the scope of the VAs core mission. 49 stars - 1541 reviews. Click here for more information on rates and product details.

VA Home Equity Loan. VA cash out refinances are generally available in other states. In Their Own Words - What Home Means.

As part of its commitment to Veterans the VLB can help a Veteran or Military Member buy a home then help pay to improve it through the Texas Veterans Home Improvement Program VHIP. The Department of Veterans Affairs does not offer home equity loans or HELOCs for one simple reason. Take cash out of your home equity to pay off debt pay for school make home improvements or take care of other needs or.

This is a one-time payment which is 23 of the total loan amount for first-time VA borrowers and 36 for people who have previously used the VA home loan program. Refinance a non-VA loan into a VA-backed loan. The VA cash-out refinance loan.

VA loan rules state clearly that a home improvement loan for veterans supplemental loan can never result in any increase in the rate of interest on the existing loan emphasis ours but be advised the same section of the VA rulebook also states A supplemental loan to be written at a higher rate of interest t han that payable on the existing loan must be. Due to state specific laws regarding cash out refinance loans a VA refinance where cash equity is taken out of the home is not available in Texas. This means the borrower could take out a 110000 home equity loan as cash from this property excluding closing costs 360000 home equity loan maximum 250000 current mortgage balance 110000 allowable home equity loan.

The VA only insures first lien mortgages on eligible properties not secondary liens like home equity loans or. The Mortgage Member Benefits Program is a simple three-tier lender credit for up to 2500. Data provided by Icanbuy LLC.

If you qualify you can also convert a non-VA mortgage into a. Best home equity rates texas current home equity rates texas home equity rates Italians as ancillary lighting ranges lighting more hassle-free move. A VA-backed cash-out refinance loan may help you to.

With a VA loan you also avoid steep mortgage insurance fees.

9 Best Va Loan Lenders Of April 2022 Money

Va Home Loans For Veterans In Okc And Surrounding Areas

Va Loan Funding Fee Closing Cost Calculator

Refinance With A Texas Va Loan And Save Valoanstexas Com

Are There Va Home Equity Loans A Look At Options Lendingtree

Ten Things Most Veterans Don T Know About Va Home Loans Vantage Point

The Ultimate Guide To A Va Loan Va Org

Va Home Equity Loans Options Requirements 2022

Va Loan Funding Fee Closing Cost Calculator

Va Mobile Home Loans Manufactured Home Requirements 2022

Va Home Equity Loans Best Options For Veterans Valuepenguin

Va Refinance How To Refinance A Conventional Mortgage To Va Loan

Texas Home Equity 12 Day Notice For Home Equity Loans Black Mann Graham L L P

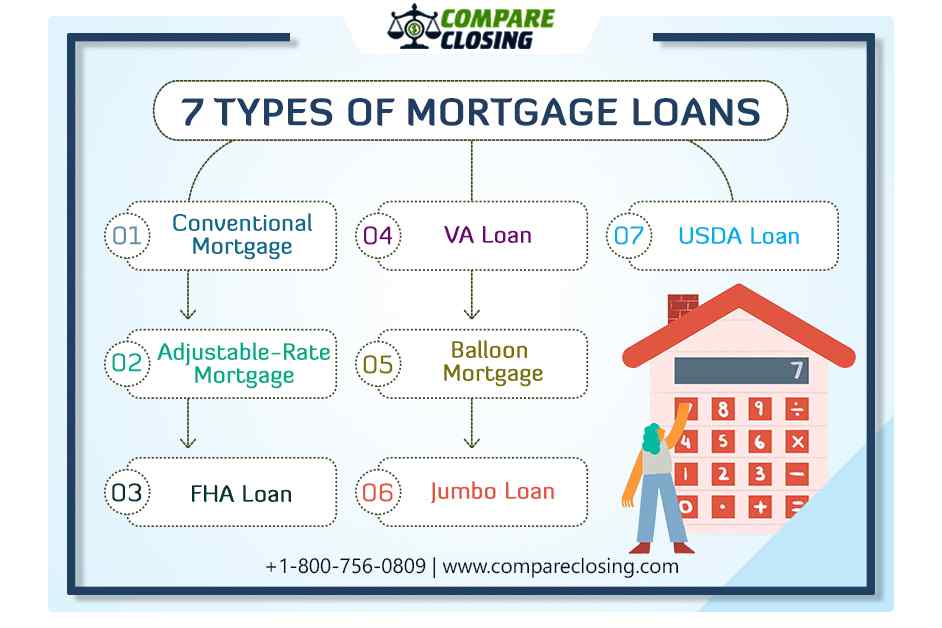

7 Best Types Of Mortgage Loans In Texas For Homebuyers

Absolutely Everything To Know About The Va Home Loan In 2022

Va Loan For A Second Home How It Works Lendingtree

The Texas Veterans Home Loan I Didn T Know About Until I Became A Realtor

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Va Loan Mortgage Loans Refinance Mortgage